Ace Info About How To Apply For Eitc

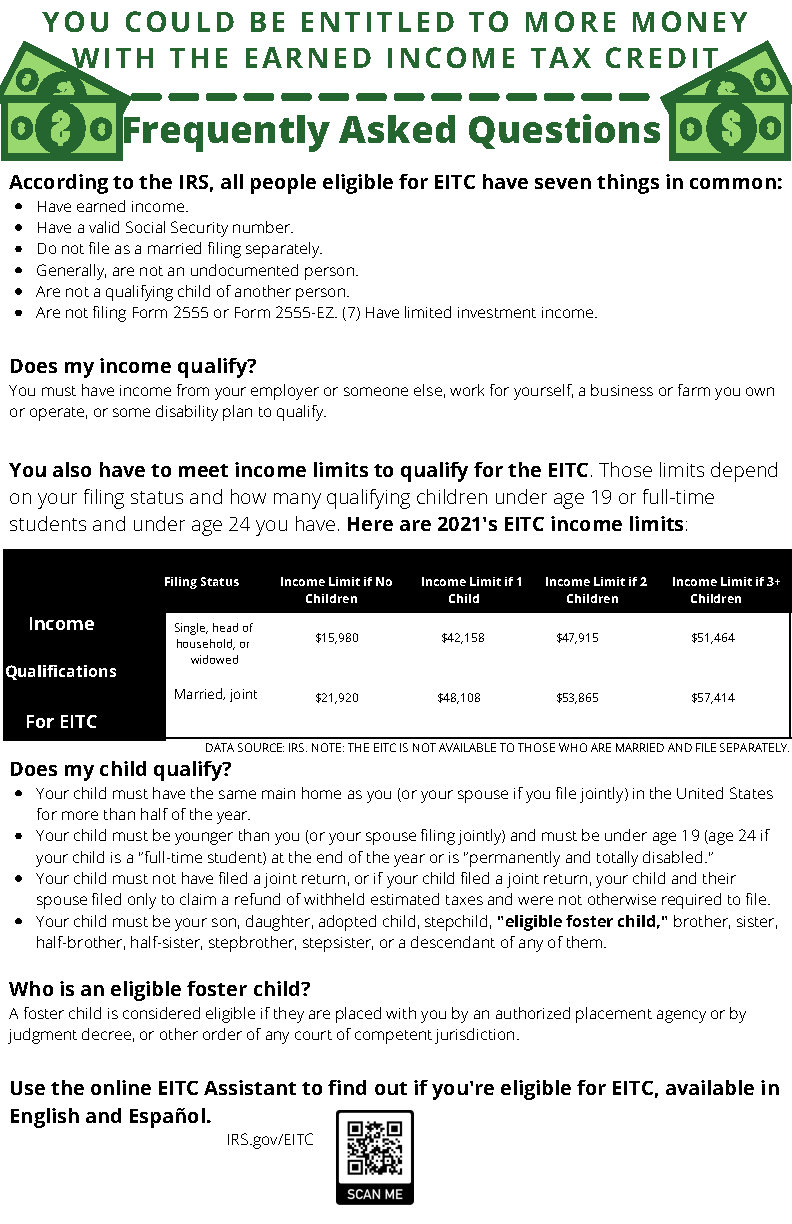

Use the irs eitc assistant by answering questions and providing basic income information, you can use the irs eitc assistant to:

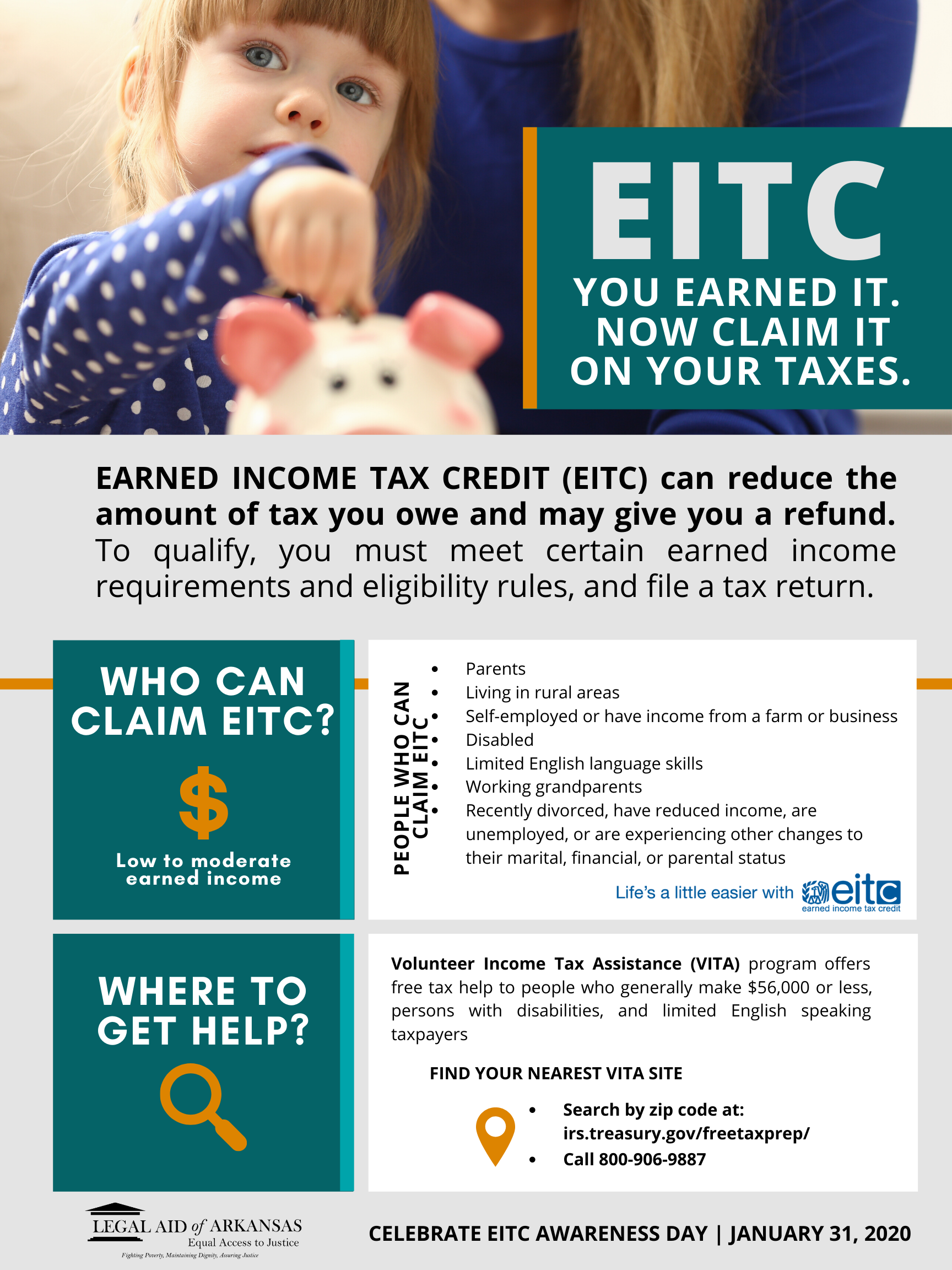

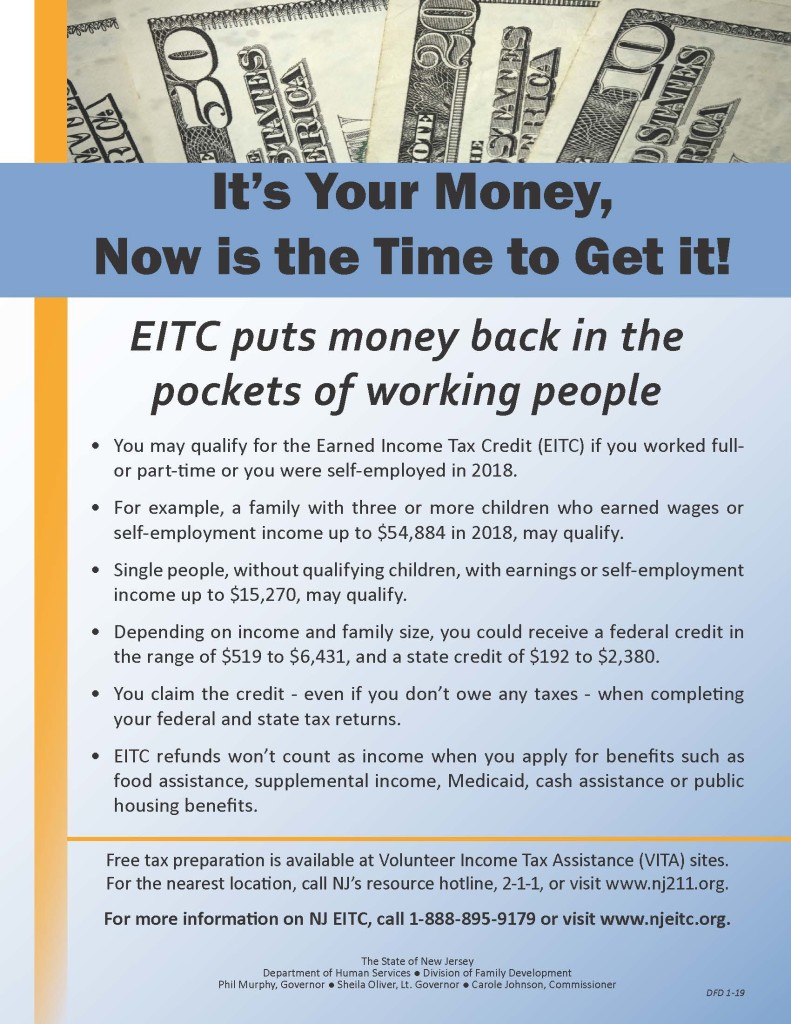

How to apply for eitc. If a person is a qualifying child for two or more persons and more than one of the persons claims the child, the irs applies the. People under 25 or over 65 must meet all other. Must have earned income from wages or running a business or a farm;

You must have a valid social security number (ssn) that is issued by the social security administration on or before the due date of your tax return (including extensions). Returning participants should enter the previous. The advanced eic can be applied for through your employer.

Access our employment center to view and apply for available city employment opportunities. To qualify for eitc you: Applying tiebreaker rules to the earned income tax credit.

Find out if you are eligible for eitc; California earned income tax credit (ftb 3514) follow these instructions: 2021 instructions for form ftb 3514;

To file a prior year tax return, complete and file form 1040 and a schedule eic, if you had a qualifying child. If you are a new participant, register for a new account. Download, complete, and include with your california tax return:

Determine if your child or. File your 2021 taxes by april 18, 2022. You will need to file your federal and new york state tax returns to claim eitc.